Charlie Barnhart & Associates is a firm that offers strategic consulting, research and training programs targeted at addressing issues at the intersection of the electronics OEM and its outsourced manufacturing providers. The firm has recently published a report entitled China v. Mexico: An Objective Comparison for Midmarket Electronics OEMs.

Over the next several weeks, The Offshore Group’s blog will contain excerpts from this informative and important document.

The third installation that appears below is from Chapter 5 of the study which provides a Mexico and China comparison that may be useful to companies considering engaging electronics manufacturing services either of the countries. In order to get a copy of the entire document, visit the Charlie Barnhart & Associates website.

So what does all this data mean for a midmarket OEM trying to decide in which low cost region to place its manufacturing?

There is no one right answer

The answer to the question of which country, China or Mexico, is best positioned to serve a North American based midmarket OEM is that, “It depends.” It depends on a multitude of factors including: what type of product it is, the distance to the end market(s) into which it will be sold, the expected build volume, inventory in transit, reverse logistic, labor content, product stability, etc. The point is that neither country is a panacea for the manufacturing needs of all OEMs.

While this may not sound very helpful to an OEM struggling with this decision, it should not be that difficult to decide if you do the homework and consider the right variables, and resist the hype associated with the manufacturing capabilities in either country. Fortunately for OEMs, a full and proper TCO (total cost of outsourcing) analysis based on actual industry data will help steer you in the right direction. Chapter 6 will present CBA’s proven methodology for conducting a proper TCO analysis.

Volume matters

One clear conclusion from this research is that neither China nor Mexico provides a full service solution across the manufacturing life-volume continuum and each is best suited for specific manufacturing processes. Our respondents ranked China and Mexico as best suited for (in order):

- High-volume manufacturing

- Continuous-flow manufacturing

- Medium-volume manufacturing

Volumes appear to matter more in China than Mexico. One respondent offered a quantification of the optimal build volumes in China this way: “The volumes need to be minimum revenue of US$3M to get into a decent Tier 2 EMS, and above US$10M for consideration at a Tier 1 EMS.”

There is considerable debate within the EMS industry on this issue and CBA is aware of lesser volume programs going to China. The question posed by our research though was how manufacturing in these countries rates for a North American based midmarket OEM compared to a USA/Canada solution. In this regard it is clear that both countries are considered best for higher volume manufacturing. This could change in the future with increased emphasis and investment by the industry in both countries.

Regionalization trend continues

Referred to in various terms such as “re-shoring”, “near shoring”, and “off shoring repatriation”, the trend towards a regional manufacturing approach continues unabated. Regionalization is when an OEM decides to build in the region into which its products will ultimately be sold. This trend is driven primarily by higher energy costs, increasing labor rates in low cost regions, and the desire to shorten supply chains and the finished goods inventory transiting therein.

CBA data has been indicating that the regional manufacturing solution has been gaining traction as this approach is now more cost-effective than a cross-hemispheric solution. The only known remaining exceptions are the extremely large consumer, communication and computing sector relationships which are now atypical to the balance of the EMS/ODM industry.

The return to regionalization, which is how the outsourcing industry actually began, should continue to benefit Mexico especially in serving North American based OEMs and also global OEMs that are selling their products into the North American market. Clearly this is influenced by the type of products, location of end markets, and volume levels as mentioned above.

The best endorsement of the regionalization trend in North America is the fact that Chinese companies are also investing in manufacturing facilities in Mexico to serve the US market. A recent example of this is a Chinese automotive company that isinvesting in the State of Yucatan.

Domestic consumption

A key consideration for an OEM in deciding on where to conduct its electronics manufacturing is the location of the end market(s) into which its product(s) will ultimately be sold. Closer is usually better, especially if the products are large and bulky.

China clearly has the advantage over Mexico since domestic consumption has been identified by the Chinese government as a key to its future economic growth while manufacturing in Mexico remains almost exclusively for export. China’s middle class is estimated to consist of 100-300 million people. This is larger than the entire population of Mexico, and, at the high end, almost equal to the population of the United States. With lots of jobs and opportunities in the country, China’s internal markets are a strong focus for most electronics OEMs. Whether or not these companies will be able to successfully penetrate the Chinese market and compete with indigenous Chinese manufacturers is yet to be determined.

Labor rates increasing and misreported

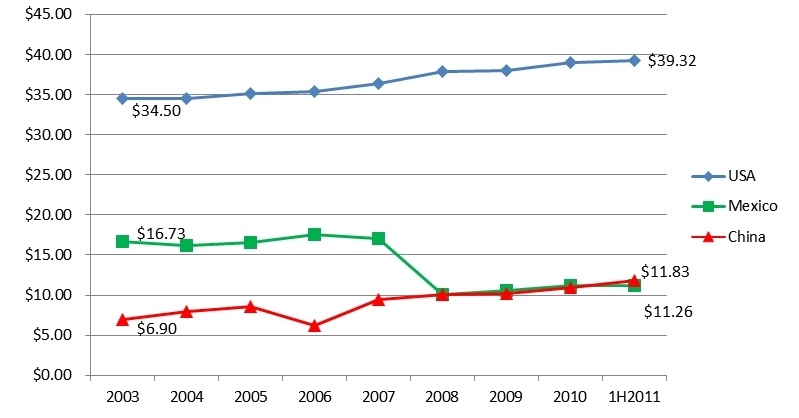

Although direct labor constitutes only a single digit percentage of the cost of an electronics product, it continues to be an issue of great focus for OEMs and EMS alike. The fact is that labor rates in the electronics manufacturing industry have been increasing for at least the past eight years.

While we are glad to see that the mainstream press has finally picked up on this trend and is reporting on it with great vigor, the reality is that many still get the facts wrong. This can be attributed to various reasons such as: using generalized country labor rates rather than electronics industry specific; focusing on unburdened instead of burdened direct labor rates; reporting the hype and not the facts.

CBA has been studying labor rates for electronics manufacturing since 2002. Our data indicates that the fully burdened direct cost of labor for PCBA has increased in all geographies, except for Mexico, since 2003. These increases are the result of many factors, including; currency conversion relative to the US dollar, slightly higher fixed-costs in most geographies, inflationary adjustments to the underlying cost of labor in virtually all geographies, and a higher Overhead burden per direct-labor hour sold due to diminished load-levels during economic downturns (i.e. loss of some economies of scale).

The issue in China has been especially noteworthy with the cost of labor for both EMS and ODM service providers there having increased significantly and is forecast by CBA to continue to increase at a rate of ~1-1.5%/month for at least the next 5-6 quarters (an aggregate of ~20-25% above Q2CY2011). In contrast, Mexico’s cost of labor which has been very stable since 2003 is forecasted by CBA to increase only very slightly (~1%) in the second half of 2011.

Figure 5.1 presents the history of the fully burdened cost of labor in China and Mexico, with the United States included for comparison sake, from 2003 through the first half of 2011.

Figure 5.1

Fully Burdened Cost of Mexico v. China Labor (Industry average per Direct Labor hour in US$)

Notes:

- 1. Values are average within geography and vary based on: a.) Skill level, i.e. different workers are paid differing amounts per hour, b.) Some activities are charged at higher or lower rates as the level of overhead they require may be different than is typical for other activities within the same operation and c.) Even within a single geography costs can vary significantly between localities because of regional differences.

- 2. Per GPM of the ONS, formulations of all values are stated as cost to provider not price to consumer.

- 3. Mexico is composite of Guadalajara & Monterrey.

Global labor rates are constantly changing which is why CBA provides quarterly updates on labor rates and many other data sets related to the pricing of EMS/ODM services globally through our Outsourcing Navigator Council (ONC) program.

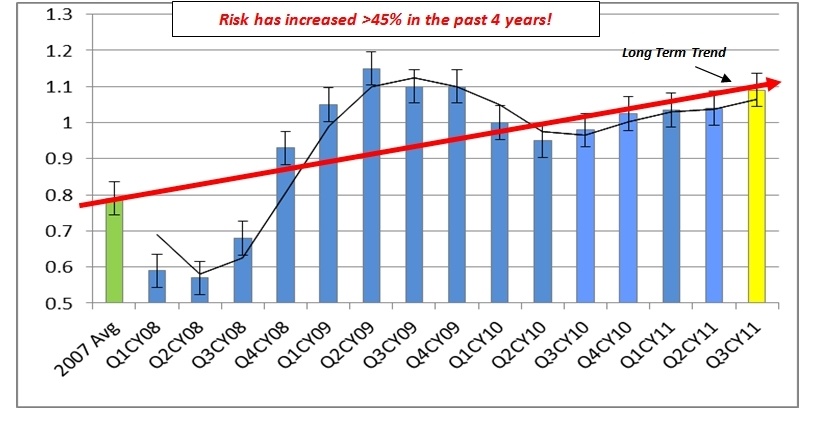

Business risk in electronics manufacturing is increasing

Risk is a constant in business. CBA produces a quarterly Composite Business Risk (CBR) indicator which is an estimate of the overall supply risk in the global electronics industry. The CBR has been indicating a consistently increasing level of risk in the global electronics industry since its inception early in CY2007. CBA believes this trend to be derivative of a decade long shift in the approach of primarily North American and European OEMs to supply chain management of low labor cost regions in remote geographies that, while economically expedient short term, has proven incongruent with global economic and geo-political realities.

Figure 5.2

CBA’s Composite Business Risk Index

Note: The Composite Business Risk (CBR) indicator is an estimate of the overall supply risk in the global electronics industry and is related to the Geographic Constant in the Global Risk Module of the Outsourcing Navigator Series but also includes; monetary exchange, economic forecasts, infrastructure scalability, cost & availability of resources (including energy), outstanding regulatory and geo-political issues, status of down-slope supply-chain, availability of up-slope services, cost & availability of capital, fixed asset utilization rates, book-to-bill ratios, current delivery trends, lead-time projections and a quality rating factor.

Country specific risks must be considered

Besides the macro trend of increased business risk, there are specific concerns associated with both China and Mexico (see section 4.3). In China the greatest concern is the theft of intellectual property (IP), while in Mexico the main concern is with physical safety.

China has long been notorious for IP theft. Stories about this problem have been around for as long as the electronics industry has been there. Stories of overbuilding of products, finding scanners installed in shredders, and outright copying of products have become so common as to not even raise much attention or outrage anymore. China’s government inaction on this issue, despite regular scolding from the US government and business groups, has emboldened the thieves to higher levels. Recent reports out of China are now of entire Apple[1] and Ikea[2] stores are faked. This situation was aptly summarized by this reporter:

“The proliferation of the fake stores underlines the slow progress that China's government is making in countering a culture of a rampant piracy and widespread production of bogus goods that is a major irritant in relations with trading partners.”[3]

The bottom line is that IP theft remains a major concern in China and a midmarket OEM needs to consider this risk thoroughly before placing any production there. While there are steps that can be taken to minimize the risk of IP theft, no sure proof solution yet exists.

Physical safety has become the main concern associated with Mexico. Since President Calderon began confronting the Mexican drug cartels in 2006, more than thirty thousand people have been killed.[4] This has made both business people and tourists rightfully nervous about visiting Mexico. While much of the violence has been centered along the US-Mexico border, there have been incidents in other areas as well, including Monterrey and Guadalajara.

The bottom line is that while the drug war continues in Mexico there will be concerns about physical safety. Fortunately, the electronics manufacturing industry has thus far been relatively unaffected by the violence. We can only hope this trend continues. Midmarket OEMs already manufacturing in Mexico or considering placing some there should proceed with caution not paranoia.

International Human Resource (HR) challenges

Managing international operations can be challenging for many reasons not least of which is the differences that exist among national cultures. An OEM will have to manage these issues to some degree whether they outsource their manufacturing or operate their own facilities in a different country. Compliance with local labor laws is crucial, but even more so is effective management of the indigenous workers. Maintaining expectations based on the workforce behaviors in your home country can result in failure in both China and Mexico.

The main HR issues that surfaced in our research for this report were related to work ethics and the need for oversight.

“If you think you are a good leader, try to boss around somebody else’s dog”

This old business adage is very applicable to this issue, and the use of the term dog is not meant as an insult to the workers in either China or Mexico. In general, Chinese workers are characterized as displaying a very positive work ethic and a “can do” attitude. Mexican workers, in contrast, are sometimes characterized by our survey respondents as lacking a strong work ethic and demonstrating a “mañana” attitude. Such general characterizations tend to reflect a preferential bias towards one country over the other and prove not to be that helpful or accurate when actually engaging in either country. What is important for North American based midmarket OEMs to know is that workers in both countries will be different from workers in the USA or Canada and must be treated accordingly. So do not assume that your stellar leadership skills that have made you successful in the USA or Canada will guarantee you success in China or Mexico.

A widely accepted “best practice” in this regard, based on feedback from survey respondents, industry veterans, and CBA’s own experience in these regions, is to rely heavily on local managers to directly manage business operations including the indigenous workforce. In China the preference has been to send over an American- born Chinese or to hire an ethnic Chinese person who has lived in the USA for years. In Mexico there has been a preference, especially in the manufacturing facilities’ along the US border, to hire American general managers who usually still live on the US side of the border and commute over to the facility every day. Mexican national general managers have also been quite common, but even when the GM is an American there will always be other senior managers who are

Mexican nationals. The option of conducting business through a manufacturing shelter (see section 2.4) in Mexico also helps minimize the impact of this issue.

“Boots on the Ground”

Regardless of how good an EMS’ manufacturing operations are in China or Mexico, OEMs should expect to visit their manufacturing sites regularly. This oversight is needed because there are a myriad of daily issues and decisions involved in a successful manufacturing operation and these cannot always be successfully managed remotely. OEMs therefore have the option of either placing a full time person in China or Mexico or travelling there on a frequent basis. Either option adds cost, but as evidenced by the comments received in our survey (see Section 4.4.1) and also from a review of articles on manufacturing in low cost regions, having “boots on the ground” is critical for OEM success in either country.

Mexico offers a better proposition for North American based OEMs in this regard due to its proximity to the USA and Canada, and the fact that a person or team can travel to Mexico and be engaged with their service suppler in the same day. This is not possible in regards to China.

In both countries the “boots on the ground” are needed to insure adherence to build protocols, integrity of the supply base (e.g., material substitution and counterfeit components), and that your business is getting the proper level of attention. President Ronald Reagan’s famous refrain about “Trust, but verify” in regards to the Soviet Union seems to be an apt analogy for OEMs to remember in regards to managing their outsourcing solutions.

“Talent wars”

While Mexico may have more years experience with the electronics manufacturing industry, both countries have very competent work forces. The advantage that China has over Mexico is that the educational system is a focus of their government while in Mexico it is not. The result is that China’s workforce is considered better educated and trained than that in Mexico. This may not matter for many unskilled jobs, but it does matter when discussing higher level professional jobs like engineering.

In A.T. Kearney’s 2011 Global Services Location Index[1], China rated #2 overall with a score of 6.49 while Mexico rated #6 overall with a score of 5.72. A close examination of the scoring reveals that China’s advantage was due to the rating given in the “People Skills and Availability” category where it was scored 2.55 versus 1.60 for Mexico.

Within both countries there exists a competitive environment for talent. Good workers will always have options. It would therefore be important for an OEM to gauge their EMS provider’s turnover rate and training programs. Advantage can be lost quickly in the EMS industry and this is largely due to the quality of the personnel.

Relationships matter

Strongly related to the HR issues is the importance of developing relationships with the people managing your manufacturing in another country. Mexico is culturally more similar to the USA than is China, and there has always been a cottage industry around bridging the culture gap between East and West. Without denying the importance of the real cultural differences that do exist, we would advise OEMs that basic common sense and courtesy are the keys.

One issue that gets a lot of attention in regards to China is the issue of “guanxi”. Guanxi is a Chinese social concept based on the exchange of favors, in which personal relationships are considered more important than laws and written agreements.[1] As such, the term refers to the relationship between people or groups that allows one party in the relationship to prevail upon the other party for help/support. Developing guanxi is usually seen as important for success in China. However, this is clearly not a dynamic that is unique to China. In fact, guanxi exists in every society and is really just good business sense. Treat other people with courtesy and respect and make your relationships reciprocal in nature and not one-sided.

Lost in translation

While English is still considered the international business language, misunderstanding and miscommunication are still common. Our survey respondents identified language and communications as a challenge for them in both China and Mexico. Effective communications is part language and part context. A good example of this is that in China the word “yes” does not always mean agreement with what was said. [2] It sometimes simply means that the other person has heard what you have said. This supports the importance of having indigenous managers involved in your business operations who can help with both language and cultural translation.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.