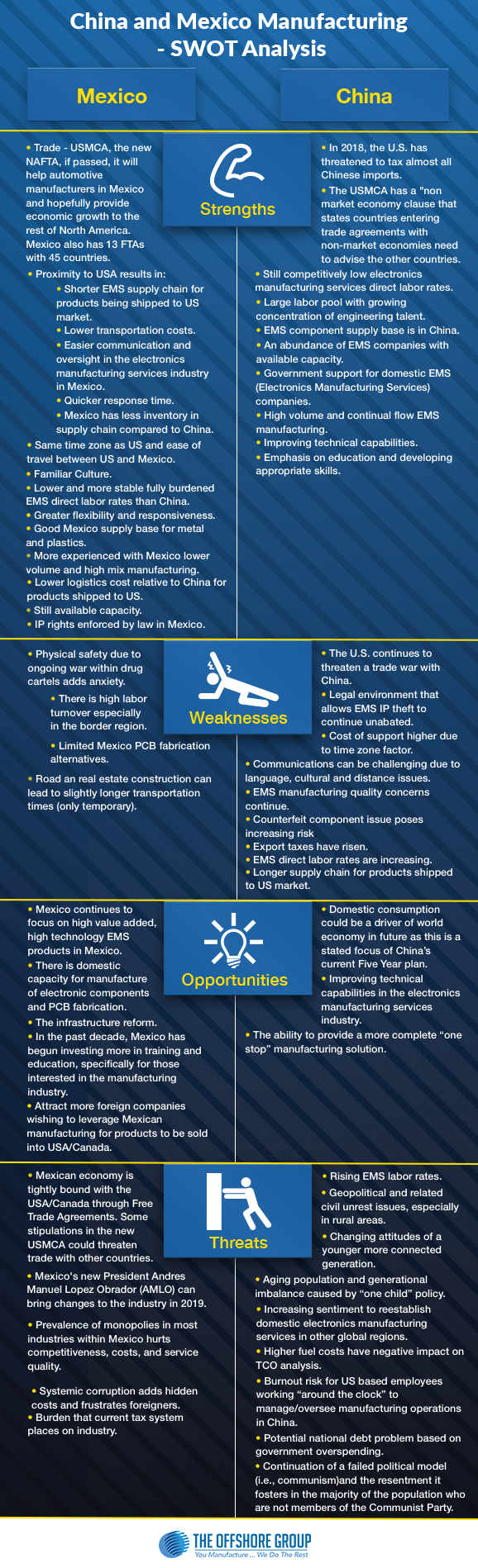

Both Mexico and China are manufacturing powerhouses that support economies around the world. The different motives companies have when expanding to another country are vast, but also specific. There is no doubt that these markets will continue to grow as the number of consumer electronics products manufactured increases. Below is a SWOT analysis of the Mexico and China Electronic Manufacturing Services.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.