More often than not, those in the manufacturing industry are accustomed to hearing about manufacturing in China, the U.S., Brazil and Japan. However, the manufacturing landscape is rapidly changing, and manufacturers in Mexico, Asia or otherwise would be wise to stay informed as new participants rise to the top.

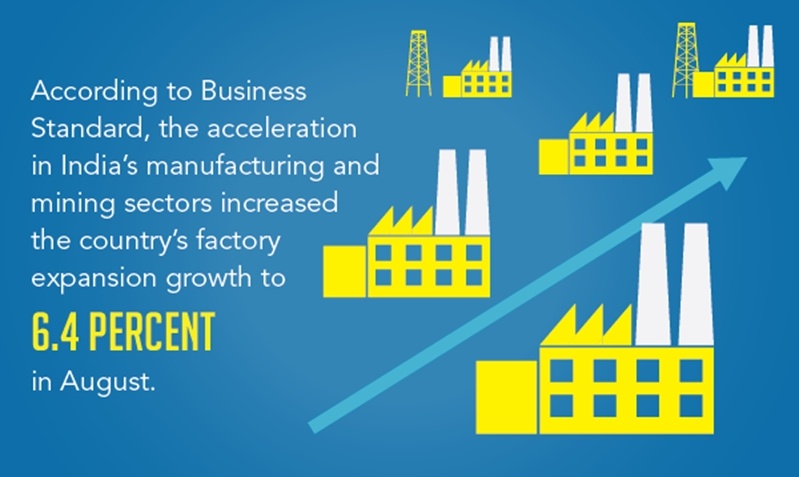

One of these key players is India. According to Business Standard, the acceleration in India's manufacturing and mining sectors increased the country's factory expansion growth to 6.4 percent in August, up from 4.1 percent in July 2015. Further, the Harvard Business Review noted a number of American companies are experiencing success in India. For example, GE hopes to boost exports by manufacturing in India and plans to send half of its output to its global factories and the other half to the domestic market in India. HBR pointed out recent manufacturing success stories in the country are strong indicators of India's resources and potential.

Key factors driving growth

There are a number of factors that have contributed to the rise of India's manufacturing sector. For one, India is the third largest economy in purchasing power parity after the U.S. and China. Educational infrastructure is also important. As HBR pointed out, the country has a large population of engineers and factory workers. Additionally, India has widely respected intellectual property laws that make manufacturing safer and more fruitful. Finally, companies have an easier time running their operations in India than they do in other countries because it is extremely easy to find English-speaking managers there.

"Ultimately, the rise of manufacturing in India has more to do with China than anything else."

It's not Mexico, it's China

Ultimately, the rise of manufacturing in India has more to do with China than anything else. In fact, the New York Times pointed out that many companies that previously manufactured in China, such as Hasbro, have changed course and moved to India, among other countries including Vietnam and Mexico.

Despite its many advantages, doing business in India is quite complicated for many companies. The Times cited Hong Kong-based Musical Group, which decided to build the latest Hasbro factory in India due to labor shortages and soaring wages in southern China. According to The Times, Musical Group and many other companies are facing difficulties surrounding India's bureaucracy and confusing situations regarding land purchases, leading to many projects falling months behind schedule. Still, companies like GE, Ford and CNH Industrial of Italy are building factories in the country in the face of increasing challenges in China. The Times outlined a few of these difficulties:

- Blue-collar wages in China have increased by more than five times in the last 10 years.

- Despite economic weakness, companies still face worker shortages.

- Some multinationals fear China is becoming a politically riskier place to do business.

As the struggles involved with manufacturing in China become more apparent, manufacturers will continue to shift their operations to India, as well as other countries that have even greater offshoring advantages.

Manufacturing in Mexico: The offshoring advantages

While it may be considered an upgrade from the current conditions in China, manufacturers in India will continue to face serious difficulties until major changes are made in the country. It makes sense, then, that so many companies are turning to Mexico for better infrastructure, more efficient supply chains and the valuable resource of highly-skilled, low cost labor. Manufacturers should consider the following benefits of manufacturing in Mexico compared to India:

- Skill: HBR noted India has a large population of engineers and factories. However, as Area Development reported, Mexico already produces more engineers annually than either Germany or Canada.

- Bureaucracy: Manufacturers in India are bombarded by red tape and bureaucracy that hinders companies trying to start operations there. Mexico, on the other hand, works closely with its network of maquiladora and shelter companies to help manufacturers do business more easily.

- Infrastructure: The Chicago Tribune reported the Mexican government has welcomed private investment in the area to foster the development of roads, highways and utilities. On the other hand, the New York Times noted India needs to significantly upgrade its roads, ports and other infrastructure that make manufacturing possible.

- Middle class: Unlike Mexico, India is still struggling to create a broad middle class. According to the New York Times, automakers sell nearly two million cars each month in China, compared with 200,000 a month in India due to the lack of spending power by its populace. Alternatively, Globe and Mail pointed out that auto industry jobs have helped strengthen the middle class so 75 percent of families in the state own their homes and university enrollment is among the highest in the region. Additionally, Mexico's growing middle class means automakers have a strong market to cater to within the country.

- Location: One of the key differences between manufacturing in Mexico and India is location. While manufacturing in Mexico requires lengthy supply chains, manufacturers in Mexico enjoy the benefit of proximity to high-demand markets, which is even further enhanced by the country's participation in the North American Free Trade Agreement.

As the manufacturing sector grows in India, there will be implications for manufacturers in Mexico as well.

As the manufacturing sector grows in India, there will be implications for manufacturers in Mexico as well.It is also important to consider that many manufacturers have fled China to Mexico for the same reasons companies are choosing to endure the challenges of doing business in India. According to official data from China's National Bureau of Statistics, China's manufacturing sector shrunk to a 3-year low in August 2015. Meanwhile, Mexico's manufacturing sector is expected to reach $18 billion by 2018, and according to MAPI, the country will continue to lead manufacturing growth in Latin America through 2016.

The supply chain impact

Advantages and disadvantages aside, India will continue to experience rapid growth of its manufacturing sector, which will affect supply chains globally, including for manufacturers in Mexico. Mexico has a very unique relationship with manufacturers across Asia because many companies, especially automakers, are moving their production or portion of manufacturing to Mexico to leverage the country's proximity to the U.S as a solution to supply chain challenges. As Foster Finley, a managing director of logistics consulting firm AlixPartners, told The Journal of Commerce, investment in manufacturing in Mexico is complementing investment in Asia. This means as more companies move their operations to India, manufacturers in Mexico must be prepared to accommodate supply chain demands from the country.

Ultimately, the key takeaway is the global manufacturing sector is experiencing a major shift as economies begin to change and technology opens new doors for innovation. As a result, companies in Mexico and otherwise need to be prepared to embrace changes in the industry.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.