North American manufacturers are turning to Mexico and nearshore facilitators like The Offshore Group to position themselves in anticipation of Mexico's expected economic growth. A young Mexican population is growing into an increasingly educated workforce, and those socioeconomic advances are bringing more families out of poverty and into the middle class. Still, despite increasing median family incomes, Mexicans remain conservative consumers, and these trends are good news for U.S. producers looking to partner with Mexico's talented work force.

Middle income families in Mexico earn between $1,200 and $9,000 each month. Recent reforms, strong trade agreements and investment in education are combining to set an aggressive rate for economic growth in Mexico, and 1.6 milling families are expected to be climbing into the middle-income bracket by 2018. In recent findings published by The Boston Consulting Group (BCG), increased purchasing power is fueling a 7 percent annual growth rate in consumer spending. New arrivals to Mexico's middle-income bracket account for a dominant 90 percent of that annual growth. However, BCG's research shows that consumers in Mexico are uncharacteristically cautious, and quality-of-life purchases like food, education and health care are expected to drive future spending.

Conservative Mexican consumers are good news for employers and U.S. manufactures. This is true for two reasons: 1) Anticipated consumer spending supports the manufacture of export products to nearby trade partners, and 2) projected spending choices support long-term and stable economic growth.

Consumer behavior in Mexico has had a huge impact on economic improvement.

Consumer behavior in Mexico has had a huge impact on economic improvement.Trends show promise for trade

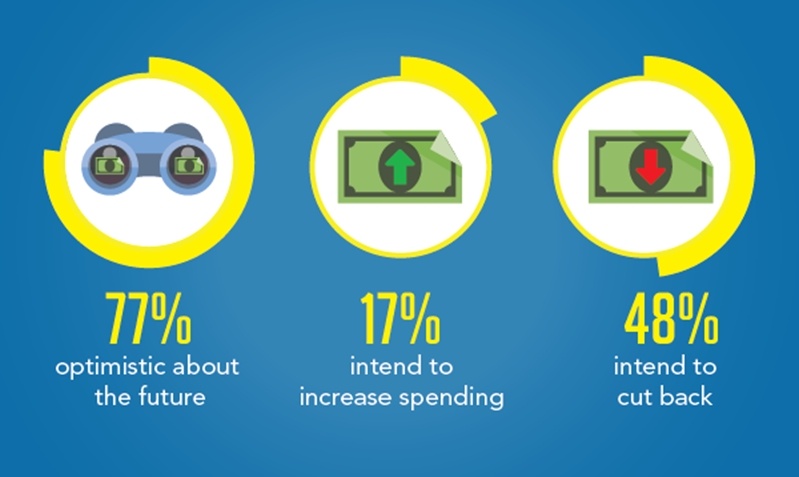

In a 2014 poll, BGC surveyed 3,000 Mexican households. When asked, 77 percent said that they were optimistic about the future. Despite that strong, bullish sentiment, only 17 percent indicated that the intended to increase their spending, and 48 percent claimed that they intended to cut back. So, how is this good for U.S. manufactures?

To find that answer, we have to look east to China. In China, the narrowing wage gap is increasing purchasing power of wage earners, just as it is in Mexico. Chinese consumers, however, are expected to display a very different set of purchasing behaviors. For instance, while first-time automobile purchases are driving consumer growth in China, 64 percent of Mexican families intend to spend more on education.

Both the Chinese and Mexican labor markets are primed for production. While the Chinese market will increasingly look to supply its own domestic demand, Mexico should continue to perform as a highly skilled and high-volume manufacturing partner. As Mexico's economy grows and its workforce becomes increasingly well trained and educated, manufacturers shouldn't expect domestic competition for traditional exports.

Long-term planning requires stability

In addition to increased spending on education, BCG's findings show quality food products and access to private health care come in close behind with 58 and 54 percent spending increases, respectively. Mexico is making healthy choices, and a young, educated population is hungry for jobs, adding an anticipated 19 million workers over the next 20 years.

To maintain economic expansion and growth, expect the Mexican government and private sector to look to stable, predictable sectors like manufacturing for investment. The Offshore Group's manufacturing communities fit Mexico's strategy for sustainable growth while creating opportunities for U.S. producers to tie into a talented, low-cost labor pool. With strong trade agreements and conservative behavior from consumers, BGC says companies "must act now" to capitalize on Mexico's meteoric rise.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.